529 education savings plans are more versatile than you may think.

May 24, 2017

Many parents and grandparents start investigating their college savings options before a new addition to the family is even born. Why? Possibly because education is a top priority for their families, and already-expensive tuition increases almost 5% every year, according to The College Board. A child born in 2016 can expect to pay anywhere from $94,800 (public) to $323,900 (private) in tuition and fees for a four-year education in 2034, when he or she turns 18. However, saving toward that goal is much more achievable if you use the tools at your disposal wisely, particularly tax-advantaged college savings vehicles.

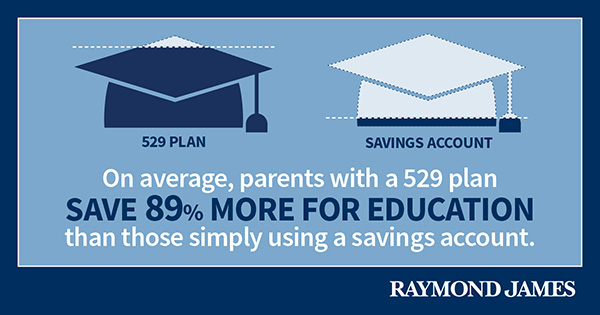

Not everyone is in a position to set aside money for the next generation without jeopardizing their own goals, but if you're fortunate enough to do so or if you can start early and save over time, it is worth looking into your options. Specialized savings accounts, informally referred to as 529s, should be at the top of your list because they offer preferential income and/or estate tax treatment. In fact, according to Sallie Mae's "How America Saves for College 2015," parents with a 529 plan save 89% more than those simply using a savings account. Here are a few advantages that parents and grandparents may want to consider.

57% of parents save for college, but most of that money is held in general savings accounts, not tax-advantaged educational savings vehicles.

Source: Sallie Mae's “How America Saves for College 2016”

Capitalize on Federal and State Tax Savings

Assets contributed to a 529 on behalf of your designated beneficiary grow tax-free. Even better? The withdrawals are tax-free as long as they're used for a qualified education expense, such as tuition, room and board, and supplies, and don't exceed the actual costs.

Most 529s are state-sponsored, which could provide additional tax savings. For example, some states offer a tax benefit to residents who invest in their state's plans. Others allow a state income-tax break if you contribute to any state's plan. It's important to understand which tax deductions or tax credits may be available– especially if you reside in a state with income tax. Your advisor can help you compare potential deductions.

Take Advantage of Flexibility

Many people worry that gifting large chunks of money to a 529 means they'll irrevocably give up control of those assets. Hard to swallow, when you've worked hard to build your net worth and can't predict if you'll need that money later. The good news is that 529s allow quite a bit of control, especially if you title the account in your name. At any point, you can get your money back. Of course, that means it becomes part of your taxable estate again, subject to your nominal federal tax rate, and you'll have to pay an additional 10% penalty on the earnings portion of the withdrawal if the money isn't used for your designated beneficiary's qualified higher education expenses.

What if your beneficiary receives a scholarship or financial aid? Well, you've got options here, too.

- First, you can earmark the money for other types of education, like graduate school.

- Second, you can change the beneficiary, as many times as you like, since most 529s have no time limits. You just need to do so before the new recipient actually heads to college. This option is particularly helpful if your designated beneficiary chooses not to go to college at all.

- Third, you can take the money and pay the taxes on any gains. Normally, you'd expect to pay a penalty on the earnings, too. But that's not the case for scholarships. The penalty is waived on amounts equal to the scholarship as long as they're withdrawn the same year the scholarship is received. Of course, you can always use the funds to pay for other qualified education expenses, like room and board, books and supplies, too.

Plus, many plans offer you diversified portfolios allocated among stocks, bonds, funds, CDs and money market instruments, as well as age-based portfolios that are more growth-oriented for younger beneficiaries and less aggressive for those nearing college age.

Bypass Gift Taxes for Five Years

A grandparent, or anyone really, can contribute up to $14,000 a year per person ($28,000 if married filing jointly, for 2017) with no gift tax consequences. Better yet, if you can swing it, you can “super fund” your 529 using the five-year accelerated gift election, a lump sum gift of $70,000 per contributor ($140,000 for married couples). The catch here is that you can't make additional gifts for the next five years, but your larger gift now has the opportunity to compound tax-free over a longer time.

Minimize Potential Estate Taxes

Estate tax benefits can be significant, especially if you have a large number of kids or grandkids you want to benefit. Once a 529 plan is funded, it is considered a completed gift to the beneficiary for federal estate tax purposes even though the owner retains full control of the account. It shifts assets out of your estate (unless you make yourself the beneficiary) and can grow tax-free until needed. If opting for a five-year election, the contributor must outlive the election or it will be prorated back on a calendar year basis.

Give Generously

Lastly, it doesn't matter how much you make, you can contribute to a 529 for anyone of any age, including yourself if you plan to go back to school. And lifetime contributions are generous as well. Depending on the state, you can contribute more than $200,000 to help your future learner avoid or minimize student debt.

What About Financial Aid?

Most Americans supplement their contributions to college expenses with financial aid of some sort, but aren't quite sure how college savings could affect future aid. There are some things to consider with 529s. You have to decide how to title the account – who will own it and who will be the beneficiary. Is it better to own the 529 plan and make your child or grandchild the beneficiary or to put the 529 plan in the beneficiary's name outright? Another option for grandparents and aunts and uncles is to contribute to an existing 529, opened and owned by the child's parents.

Did you know?

You can avoid gift taxes altogether if you make tuition payments directly to a higher education institution even after you've reached your annual federal gift-tax exclusion limits. Doing so doesn't chip away at your lifetime gift exemption either, but it is likely to adversely affect financial aid applications.

The difference is how the distributions will be treated when it comes to seeking financial aid using the common Free Application for Federal Student Aid (FAFSA) form. The FAFSA form is the key to unlocking some portion of $150 billion in available federal tuition assistance. No reason to leave money on the table if it could be better deployed to achieve your own goals, right? These decisions can be complicated, and your financial advisor should be able to offer some helpful advice beyond the basics offered below.

If the 529 is owned by the parents

In this case, 5.64% of the assets in the 529 plan will be counted toward something called the Expected Family Contribution (EFC). That amount is recalculated each year based on the end value of the account, which will steadily decline since funds will be used to pay for education expenses. If the student owns the account, 20% of the balance counts toward the student's expected contribution. That's the case for any student-owned assets, so it's important to title assets appropriately.

If the 529 is owned by anyone but the beneficiary

Technically, if the account is owned by someone other than a custodial parent or student, such as a grandparent, it is not counted for financial aid purposes. However, the distributions are. FAFSA treats the distributions as the student's income – even if it's a qualified tax-free distribution for income-tax purposes, so this has the potential of limiting the value of your gift. However, this may be avoided by delaying 529 distributions until after the student has completed his or her FAFSA application for their junior year or later. FAFSA calculations consider income from what's called the prior-prior year – for the 2017-2018 FAFSA that would mean using your 2015 tax return – so the income from distributions won't be a factor toward the end of a college career.

Not every institution relies on the federal financial aid form. Some use the CSS/Financial Aid Profile from The College Board instead, which reports and treats 529 assets as available assets, regardless of how they're owned.

The Free Application for Federal Student Aid, known as FAFSA, is the first step to receiving your share of $150 billion in loans, grants and work-study funds for college or career school

Set Your Course Now

Saving for college doesn't have to be daunting, just disciplined. It helps to take advantage of investment vehicles designed to help you along the journey. Each has its benefits and considerations, so it's wise to talk to your professional advisor before making a years-long commitment. For example, 529s, like many other investments, come with fees and are subject to market fluctuations, unless you opt for a prepaid account. And you can only make changes to your asset allocation twice a year.

On the plus side, 529s have higher contribution limits, no income limits and a low impact on financial aid eligibility. They allow for tax- and penalty-free withdrawals of principal at any time and for any purpose. The earnings portion, however, must be spent toward qualified higher education expenses. Any leftover funds withdrawn will incur federal income tax and a 10% penalty.

Talk to your advisor to see if 529s are the right way for you to give the gift of education – whether it's for a child, grandchild, family friend or even yourself.

Sources: The College Board, savingforcollege.com, kitces.com, forbes.com

Earnings in 529 plans are not subject to federal tax and in most cases state tax, as long as you use withdrawals for eligible college expenses, such as tuition and room and board. However, if you withdraw money from a 529 plan and do not use it on an eligible higher education expense, you generally will be subject to income tax and an additional 10% federal tax penalty on earnings. An investor should consider, before investing, whether the investor's or designated beneficiary's home state offers any state tax or other benefits that are only available for investments in such state's qualified tuition program.