First Trust - Monday Morning Outlook

Brian S. Wesbury – Chief Economist

Robert Stein, CFA – Dep. Chief Economist

Strider Elass – Senior Economist

Andrew Opdyke, CFA – Senior Economist

Bryce Gill – Economist

To many investors, this week’s GDP report is more important than usual. The reason is that real GDP declined in the first quarter and might have declined again in Q2. If so, this could mean two straight quarters of negative growth, which is the rule of thumb definition many use for a recession.

We think these investors are paying too much attention to the GDP numbers; the US is not in a recession, at least not yet. Industrial production rose at a 4.8% annual rate in the first quarter and at a 6.2% rate in Q2. Unemployment is lower now than at the end of 2021. Payrolls grew at a monthly rate of 539,000 in the first quarter and 375,000 in Q2. If we were already in a recession, none of this would have happened. That’s why the National Bureau of Economic Research, the “official” arbiter of recessions, uses a wide range of data when assessing whether the economy is shrinking.

In addition, it’s important to recognize that once a year the government goes back and revises all the GDP data for the past several years. That happens in July, including with the report arriving this Thursday. Given the strength in jobs and industrial production, it wouldn’t surprise us at all if Q1 is eventually revised positive.

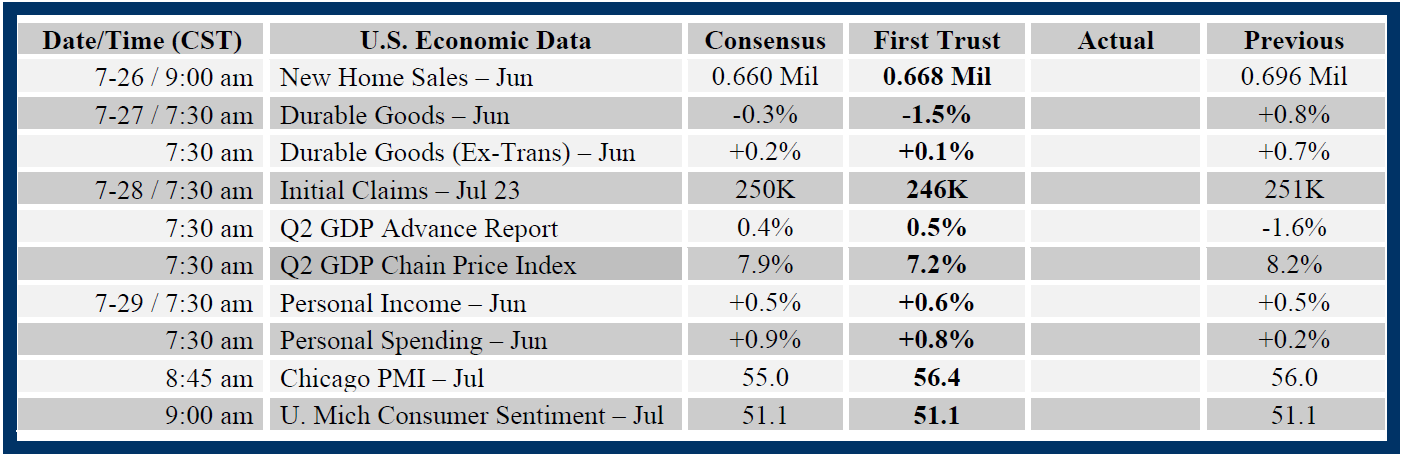

In the meantime, we are forecasting growth at a +0.5% annual rate in Q2. Here’s how we get there.

Consumption: “Real” (inflation-adjusted) retail sales outside the auto sector grew at a 2.2% annual rate, and it looks like real services spending should be up at a solid pace, as well. However, car and light truck sales fell at a 19.7% rate. Putting it all together, we estimate real consumer spending on goods and services, combined, increased at a modest 1.2% rate, adding 0.8 points to the real GDP growth rate (1.2 times the consumption share of GDP, which is 68%, equals 0.8).

Business Investment: We estimate a 5.5% annual growth rate for business equipment investment, a 7.5% gain in intellectual property, but a 4.0% decline in commercial construction. Combined, business investment looks like it grew at a 4.4% rate, which would add 0.6 points to real GDP growth. (4.4 times the 14% business investment share of GDP equals 0.6).

Home Building: Residential construction looks like it contracted at a 4.0% annual rate. Mortgage rates should eventually become a headwind, but, for now, it looks like an increase in spending on construction was more than accounted for by inflation in construction costs. A decline at a 4.0% rate would subtract 0.2 points from real GDP growth. (-4.0 times the 5% residential construction share of GDP equals -0.2).

Government: Remember, only direct government purchases of goods and services (and not transfer payments like unemployment insurance) count when calculating GDP. We estimate these purchases – which represents a 17% share of GDP – were roughly unchanged, which means zero effect on real GDP.

Trade: Exports have surged through May while imports, after spiking late in the first quarter, have remained roughly flat so far in Q2. That means a smaller trade deficit. At present, we’re projecting net exports will add 1.0 point to real GDP growth, although a report on the trade deficit in June, which arrives on July 27, may alter that forecast.

Inventories: Inventories look like they grew at a slower pace in the second quarter than they did in Q1, suggesting a drag of about 1.7 points on the growth rate of real GDP. However, just like with trade, a report out July 27 may alter this forecast.

Add it all up, and we get 0.5% annual real GDP growth for the second quarter. Monetary policy will eventually tighten enough to cause a recession, but that recession hasn’t started yet.

The attached information was developed by First Trust, an independent third party. The opinions are of the listed authors at First Trust Advisors L.P, and are independent from and not necessarily those of RJFS or Raymond James. All investments are subject to risk. There is no guarantee that these statements, opinions, or forecasts provided in the attached article will prove to be correct. Individual investor's results will vary. Past performance does not guarantee future results. Forward looking data is subject to change at any time and there is no assurance that projections will be realized. Any information provided is for informational purposes only and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.