First Trust Monday Morning Outlook

Brian S. Wesbury - Chief Economist

July 24, 2023

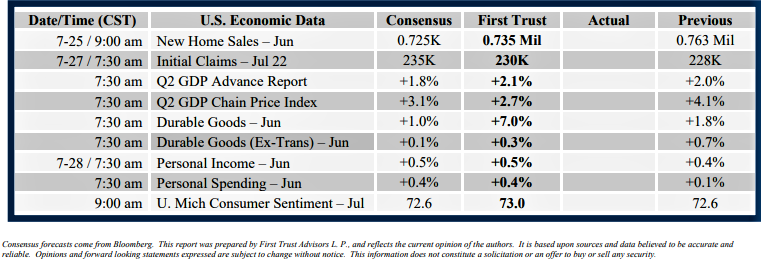

No one should be popping champagne when they see Thursday’s GDP report. The good news is that it won’t be negative. The bad news is that even if it hits our estimate of 2.1% this is a far cry from the robust growth of the economic expansions in the 1980s and 1990s.

The US is in desperate need of policies that raise the long-term growth of the US economy, policies that encourage more capital formation, better education, and making it easier to raise the next generation.

In the meantime, we still think the US is headed toward a recession, but it wasn’t in one in the second quarter. Be careful, though. While some others say we can’t fall into a recession because the job market is so strong, it’s important to realize that the job market is almost always at or near a peak when the economy enters a recession. This doesn’t mean the recession has to be anywhere near as severe as the COVID Lockdown or even the Great Recession/Financial Panic of 2008-09. But even a mild recession will bring some pain.

In the meantime, however, the economy grew at a moderate rate in Q2, which we estimate at 2.1% annualized.

Consumption: “Real” (inflation-adjusted) retail sales outside the auto sector declined at a 3.3% annual rate in Q2. However, sales of autos and light trucks increased at a 9.5% rate and it looks like real services, which makes up most of consumer spending, should be up at about a 2.5% pace. Putting it all together, we estimate that real consumer spending on goods and services, combined, increased at a tepid 1.2% rate, adding 0.8 points to the real GDP growth rate (1.2 times the consumption share of GDP, which is 68%, equals 0.8).

Business Investment: We estimate a 7.5% growth rate for business investment, with gains in intellectual property and commercial construction once again leading the way. A 7.5% growth rate would add 1.0 points to real GDP growth. (7.5 times the 13% business investment share of GDP equals 1.0).

Home Building: Residential construction is showing some resilience in spite of some lingering pain from higher mortgage rates. Home building looks like it declined at a 2.6% rate, which would subtract 0.1 points from real GDP growth. (-2.6 times the 4% residential construction share of GDP equals -0.1).

Government: Only direct government purchases of goods and services (not transfer payments) count when calculating GDP. We estimate these purchases – which represent a 18% share of GDP – were up at a 2.3% rate in Q2, which would add 0.4 points to the GDP growth rate (2.3 times the 18% government purchase share of GDP equals 0.4).

Trade: Looks like the trade deficit expanded in Q2, as both exports and imports declined but exports declined faster. We’re projecting net exports will subtract 0.9 points from real GDP growth.

Inventories: Inventories look like they grew faster in Q2 than in Q1, suggesting they’ll add about 0.9 points to the growth rate of real GDP. When a recession hits, we expect inventory declines to play a significant role in the drop in GDP.

Add it all up, and we get a 2.1% annual real GDP growth rate for the second quarter.

The attached information was developed by First Trust, an independent third party. The opinions are of the listed authors at First Trust Advisors L.P, and are independent from and not necessarily those of RJFS or Raymond James. All investments are subject to risk. There is no guarantee that these statements, opinions, or forecasts provided in the attached article will prove to be correct. Individual investor's results will vary. Past performance does not guarantee future results. Forward looking data is subject to change at any time and there is no assurance that projections will be realized. Any information provided is for informational purposes only and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.