First Trust Economics

Three on Thursday

Brian S. Wesbury - Chief Economics

October 24, 2024

Milton Friedman famously stated, “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can only be caused by a more rapid increase in the quantity of money than in output.” Contrary to popular belief, inflation doesn’t stem from rising wages, greedy businesses, government deficits, or even rapid economic growth—it results from the excessive printing of money. In this week’s “Three on Thursday,” we break down inflation in the simplest terms. This is especially relevant today, as many people attribute the significant inflation of recent years solely to massive government spending or supply chain disruptions. However, these factors alone weren’t the root cause. For a deeper dive, explore the three graphics below.

Imagine a simple economy with only $10 and 10 apples. Since there are no other goods, each apple costs $1. Now, suppose the federal government wants to spend $2. The government typically spends money by either taxing or borrowing from the people who hold those dollars. So, let’s say they decide to tax $2 from the rich apple growers and give the $2 to others. After this, there are still $10 circulating in the economy—$2 that government redistributed and $8 with the other holders. Nothing fundamental changes: the total money in the economy remains $10, and there are still 10 apples, so each apple still costs $1. This illustrates why government spending, in itself, does not directly cause inflation. The money supply hasn’t increased; it’s just been redistributed.

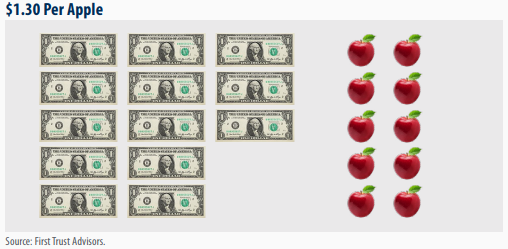

Inflation occurs when the money supply grows faster than the amount of goods and services available. Let’s consider a scenario where the Federal Reserve increases the money supply by 30%, from $10 to $13. What happens next? If the production of apples doesn’t increase by the same 30%, and remains constant at 10 apples, each apple will now cost $1.30 instead of $1. This is because there’s more money in the system, but the number of goods (in this case, apples) hasn’t changed, leading to more money chasing the same amount of goods— inflation! Looking at what happened in 2020 and 2021, the money supply in the U.S. grew by 40% in less than two years! However, production didn’t increase nearly as much. As a result, there was significantly more money in circulation chasing only a slightly larger number of goods, causing the inflation we experienced.

Let’s enhance the scenario by considering the impact of government regulation. Initially, we planned to produce 10 apples, but the EPA says the herbicide we use is bad for the spotted-bluejay, so we can’t use it, and only 5 apples can be produced. This means that while the money supply has increased by 30%, production has dropped by 50%. As a result, the price of each apple rises to $2.60. We eventually invent a new herbicide after immense expense allowing production to return to 10 apples. However, even then, the price will remain elevated at $1.30 due to the earlier inflation. It’s only when production increases to 13 apples that prices can return to the original $1 per apple.

The attached information was developed by First Trust, an independent third party. The opinions are of the listed authors at First Trust Advisors L.P, and are independent from and not necessarily those of RJFS or Raymond James. All investments are subject to risk. There is no guarantee that these statements, opinions, or forecasts provided in the attached article will prove to be correct. Individual investor's results will vary. Past performance does not guarantee future results. Forward looking data is subject to change at any time and there is no assurance that projections will be realized. Any information provided is for informational purposes only and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.