First Trust Three on Thursday

Brian S. Wesbury - Chief Economist

June 27, 2024

In this week’s installment of “Three on Thursday,” we take a look at the surge taking place in net interest payments on treasury debt securities. Each year, when the U.S. incurs a deficit, it contributes to the growth of our national debt. The current outstanding federal debt has surpassed a staggering $33.6 trillion. However, what truly counts is the government’s ability to meet all the interest payments on this accumulating debt. In the last 12 months through May, federal net interest payments have soared to an unprecedented total of $836.1 billion. This figure represents the highest level ever recorded in our nation’s history. It’s important to note that as long as interest rates remain elevated and the government continues to accumulate new debt while refinancing old debt at higher interest rates, this number is poised to rise even further. To provide further insight, we’ve included three informative charts below.

For fiscal year (FY) 2024, ending on September 30th, the OMB estimates that interest on Treasury debt securities will reach $1.144 trillion. However, a more accurate measure of the financial burden of debt servicing is net interest on the federal debt, which excludes the interest payments the government pays itself as part of an accounting gimmick used for trust funds and other government accounts. These intragovernmental interest payments are designed to give the beneficiaries of these programs more confidence that their benefits will be paid in the future, but these interest payments do not affect the overall budget deficit. For FY 2024, the federal government is expected to pay itself $255.0 billion in interest income, making the net interest payments for the year an estimated $888.6 billion.

Net interest payments on government debt, projected at $888.6 billion for FY 2024, would set an all-time high, marking a 35% increase from the previous year, 136.9% over the past five years, and 288.1% over the past decade. Net interest’s share of total federal government spending is estimated to reach 12.8% in FY 2024, the highest since 1999 and nearly matching 2024 FY defense spending, which is projected at 13.1% of government spending. With interest rates elevated compared to the past 20 years and massive deficits forecasted ($1.87 trillion estimated for FY 2024 alone), net interest payments are expected to continue growing, occupying a larger portion of government spending over the next decade.

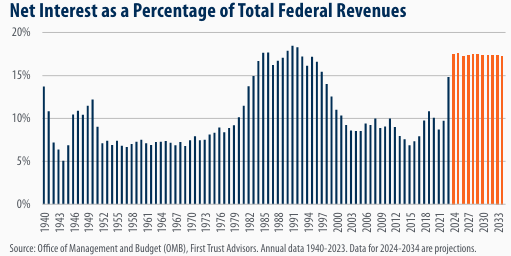

In the late 1970s, rising national debt and higher interest rates led to a significant increase in interest costs, peaking at 18.4% of federal revenues in 1991. However, smaller budget deficits and lower interest rates caused this ratio to decline over the following decade. From 2003 to 2018, interest outlays remained at or below 10% of federal revenues, despite substantial borrowing, due to low interest rates. Recently, the combination of rising interest rates and mounting debt has pushed net interest as a share of revenues to 17.5% in FY 2024, the highest level since 1992.

The attached information was developed by First Trust, an independent third party. The opinions are of the listed authors at First Trust Advisors L.P, and are independent from and not necessarily those of RJFS or Raymond James. All investments are subject to risk. There is no guarantee that these statements, opinions, or forecasts provided in the attached article will prove to be correct. Individual investor's results will vary. Past performance does not guarantee future results. Forward looking data is subject to change at any time and there is no assurance that projections will be realized. Any information provided is for informational purposes only and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.