Third, the Fed, as well as many analysts/economists, were expecting inflation to start turning the corner at the end of the first quarter of this year (yes, this was the ‘transitory’ argument) but a new and unexpected external shock changed the timing for inflation to start coming down: the Russia/Ukraine war. Thus, the Fed doesn’t want another potential external shock to further undermine its inflation fighting credibility and has decided that this time around, it is not waiting for things to happen on their own, and it is ok with increasing interest rates further and pushing the US economy into a recession.

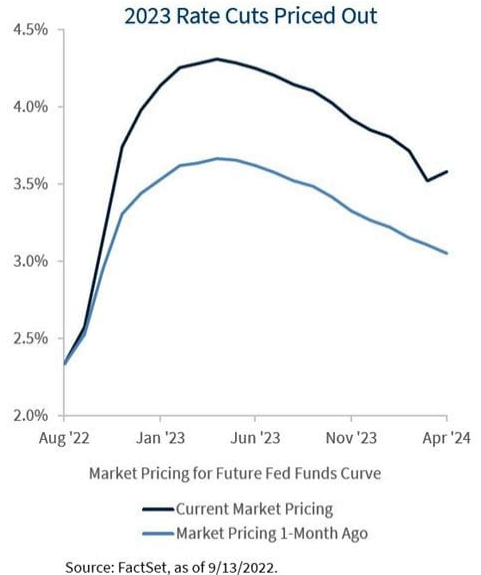

Fourth, because of all this, the Fed is expecting inflation to come down at a slower pace than what it was expecting before through a process that is called disinflation. And it is betting the house on its success. This is the reason why the strategy has changed to ‘higher for longer.’ The Fed has put out its worst-case scenario, something that should be music to the markets’ ears.

For the markets, this should be good news even if it is very difficult to see it at this point. Since this is the worst-case scenario for the Fed, any ‘better-than-expected’ news in the inflation front should be a boon for markets

NAHB Housing Index: The NAHB/WF Housing Market Index continued to decline in September, which is another clear indication of the impact of higher mortgage interest rates on sales of single-family homes. Additionally, we expect the other housing market releases this week (housing starts, existing home sales, and building permits) will show similar weakness. Bad news continues to be good news for the Fed, as it indicates its tightening cycle is working to slow demand. The NAHB/WF Housing Market Index dropped further in September to 46 from a reading of 49 in August, while consensus was expecting a reading of 48. This was the ninth consecutive monthly decline in the index, taking it further below the all-important 50 break-even level, suggesting additional deterioration in the US housing market. The index for current single-family sales remained above the 50-demarcation point, at 54, but the index for single-family homes in the next six months dropped to 46 compared to 47 in August. Similarly, prospective buyer traffic continued to shrink to a level of 31. Most of these indicators are hovering around their lowest levels since 2014 if we take out the decline induced by the COVID-19 pandemic in 2020. The only region that remained barely above the 50-demarcation point continues to be the South, with a reading of 52. Furthermore, the Northeast reported a reading of 48 compared to 49 in August, while the Midwest remained unchanged at 42, and the West dropped even further in September to 34. With mortgage rates continuing to increase and the NAHB/WF Housing Market Index remaining below the 50-demarcation level between expansion and contraction, the housing market is slowing down and is likely to continue to do so. Although the current single-family index for sales remained above 50, the forward-looking part of the index showed very weak expectations going forward.

Housing Starts & Building Permits: Housing starts bounced back in August after plunging in July, recovering to the June 2022 levels. While both segments (single family and five or more units) increased, multi-family housing led the charge as higher mortgage rates and rents are increasing demand for more affordable housing. On the other hand, building permits experienced the largest decline since the pandemic began in March 2020, reaching their lowest level since June 2020. Overall, tighter monetary policies continue to negatively impact the housing market and are making home ownership unaffordable to many. Housing starts in August increased to a seasonally adjusted annual rate of 1.575 million or a 12.2% increase compared to the revised July estimate of 1.404 million, according to the US Census Bureau and the US Department of Housing and Urban Development. This represents approximately the same level reported in August of last year. Single-family housing starts were 935,000 in August or 3.4% higher than the 904,000 million reported for July. On the other hand, building permits declined 10% in August, down to 1.517 million from 1.685 million in July. Compared to August 2021, building permits are down 14.4%. Single-family building permits were 899,000 in August, or 3.5% below the revised July level of 932,000. Building permits of five or more units were 571,000 in August, compared to 701,000 in July. Housing completions were at a seasonally adjusted annual rate of 1.342 million or 5.4% below the July revised estimate of 1.419 million, and 3.1% above the August 2021 rate of 1.302 million. With the average 30-year mortgage rate exceeding 6%, both builder sentiment (as shown in yesterday’s NAHB/WF release) and buyers’ ability to afford single-family homes continued to decline. Looking ahead, as the Fed continues to raise rates to tame inflation, the housing market is likely to get gloomier.

Existing Home Sales: Existing home sales continued to decline in August both on a month-over-month basis as well as compared to last year. Home prices for existing home sales were down compared to July but they are still positive year-over-year. Meanwhile, the supply of homes held steady, at 3.0 months, in August and on a seasonally adjusted basis. Existing home sales decreased by 0.4% in August, to a seasonally adjusted annual rate of 4.80 million according to the National Association of Realtors. Compared to August of last year, existing home sales declined 19.9%. The decline in existing home sales in August was less than what consensus was expecting. The median sales price of existing home sales was $389,500 in August, down from a median sale price of $399,200 in July. Home prices were up 7.7% versus August of last year for the US as a whole. Regionally, they were up 1.5% in the Northeast, 6.6% in the Midwest, 12.4% in the South, and 7.1% in the West, all compared to the same month a year earlier. Although existing home sales were stronger than the consensus expected in August, they were still down compared to July while the median price of existing homes continued to decline, a clear signal that the housing market continued to weaken in August.

Initial Jobless Claims: This was the first increase in jobless claims in several months, but claims remain at non-recessionary levels. This means that the labor market is still strong and higher interest rates are still not having the effects the Federal Reserve has been looking for. Initial jobless claims increased by 5,000 during the week ending on September 17, to a level of 213,000, according to the Department of Labor. This was the first increase in initial jobless claims since early August. However, the four-week moving average was still down, by 6,000 from the previous week, at 216,750. Meanwhile, the advanced seasonally adjusted insured unemployment rate was 1.0% for the week ending September 10 and unchanged from the previous week. There was no state reporting an increase of more than 1,000 claims during the week ended on September 10, 2022, while there were six states reporting a decline in claims of more than 1,000. The states were CA with 3,064 less claims but no sectoral comments; NY, with 2,905 fewer layoffs in the transportation and warehousing, health care and social assistance, and real state and rental and leasing industries; TX, with 2,493 less claims but no sector comment; OK with 1,729 less claims but no comments on the sectors affected; PA with 1,355 less claims in the transportation and warehousing, accommodation and food services, construction, and health care and social assistance industries; and GA with 1,337 less claims in the administrative and support and waste management and remediation services, transportation and warehousing, professional, scientific and technical services, and health care and social assistance industries.

Leading Economic Index: The Leading Economic Index (LEI) continued to point to a weakening US economy in August. We should continue to see weakness in the LEI in the coming months as higher interest rates continue to weigh on the strength of the US labor market. The Conference Board Leading Economic Index declined 0.3% in August, to 116.2, after posting a decline of 0.4% in July. This was the sixth consecutive monthly decline for the index and the Conference Board projects a recession in the coming quarters. This is because of the Federal Reserve’s (Fed) rapid tightening of monetary policy, which ultimately will have an impact on the labor market, as suggested by a Senior Director at the Conference Board: “Labor market strength is expected to continue moderating in the months ahead. Indeed, the average workweek in manufacturing contracted in four of the last six months—a notable sign, as firms reduce hours before reducing their workforce.” The Fed’s hawkish tone at the Federal Open Market Committee meeting on September 21 indicated that interest rates will be higher for longer, with a forecasted federal funds rate at ~4.5% by the end of the year. This LEI reading just confirms our view of a weakening economic environment in the US, and, with the Fed now expected to hike rates into restrictive territory, the US economy is likely to enter a recession in the next quarters.